Cut applies to new and existing customers as competition increases

Bank of Ireland is cutting all its fixed mortgage rates by 0.5pc in a move that will benefit thousands of householders.

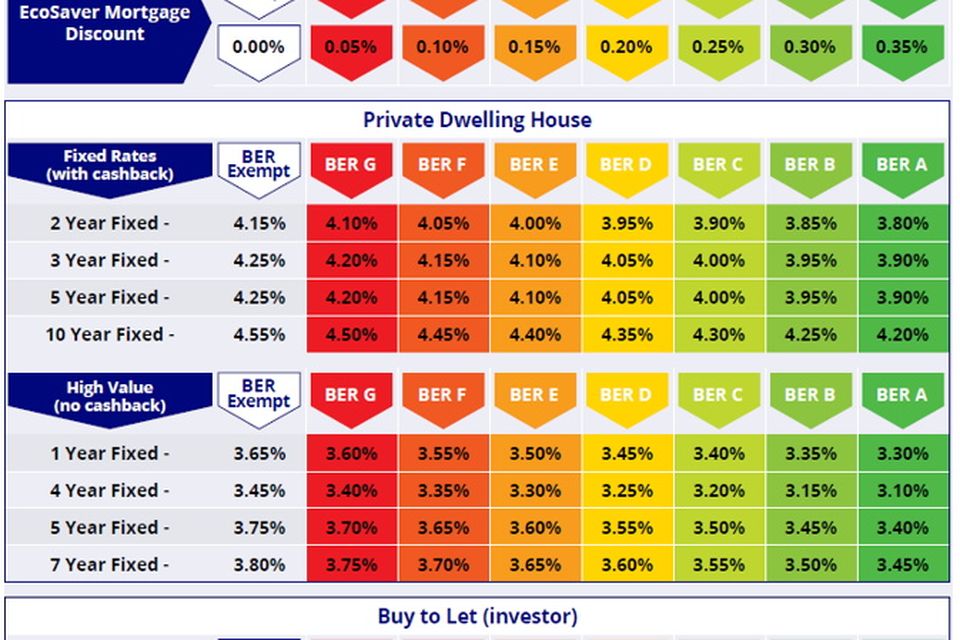

It’s cutting the rate from today for all new and existing customers, and for all homes with a building energy rating (BER) of between A and G.

The move comes amid intensifying competition among lenders as rates fall.

Today’s reduction by Bank of Ireland means that a four-year fixed rate can be obtained for as little as 3.1pc, depending on the property’s BER. That could mean a saving of about €1,000 on a €300,000 mortgage when compared to the previous four-year fixed rates.

The bank is also introducing a new one-year fixed-rate product, with no cashback, with rates starting from 3.3pc for mortgages of €250,000 and over.

The decision by Bank of Ireland to cut its fixed rate comes as the European Central Bank looks poised to continue cutting lending rates as inflation eases

The ECB cut its key interest rate by 0.25 percentage points to 3.25pc last month. That was its third cut so far in 2024.

Figures from the Central Bank of Ireland last week showed that new mortgage rates have declined to their lowest levels since July last year.

The average Irish mortgage rate fell to 4.08pc in September.

Today’s News in 90 Seconds – November 19th

Bank of Ireland’s director of homebuying, Alan Hartley, said the cut to its fixed rate mortgages is being applied to the bank’s “full suite of fixed rate products”.

“These reduced rates are available to all new and existing customers from today and they apply all the way up and down the BER scale, not just to those homes with the best energy ratings,” he pointed out.

Bank of Ireland announced today that it is also altering some of its deposit accounts from today.

It’s eliminating its 24-month fixed-term deposit product that carriers a 2.9pc annual equivalent rate (AER).

It’s introducing a new 18-month fixed term deposit account with an AER of 2.98pc.