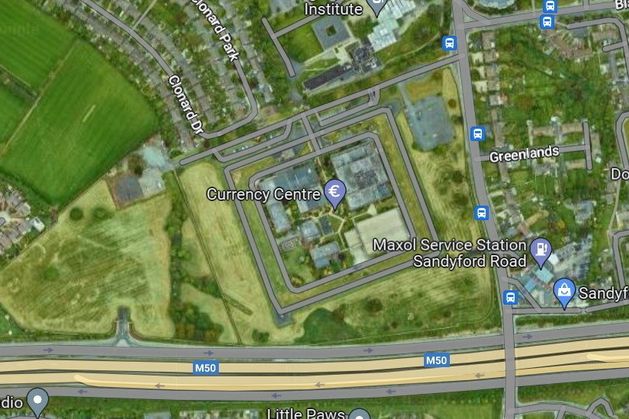

The Currency Centre site in Sandyford, Dublin. Photo: Google Maps

The Central Bank of Ireland has failed in its attempt to have certain land at its Currency Centre campus at Sandyford, Co Dublin, excluded from the State’s Residential Zoned Land Tax (RZLT).

An Bord Pleanála has dismissed the Central Bank’s appeal against Dún Laoghaire-Rathdown Co Council’s decision to have the land in question subject to the land-hoarding levy.

The Central Bank owns a 37-acre campus at Sandyford that has been the home of Ireland’s national mint since 1970.

Most of the land subjected to the levy is greenfield and located to the west of the Central Bank’s Currency Centre and to the north of the M50.

The Central Bank parcel of land at Sandyford is potentially worth more than €70m.

Central Bank head office in central Dublin. Photo: Getty

In a submission to the appeals board, the Central Bank said the land in question was required and integral to a public administration facility, which comprises the Central Bank’s Currency Centre and, therefore, should benefit from the exclusion of the RZLT regime.

The Central Bank also argued that the Currency Centre was a facility of strategic national importance.

It said the land was essential to the security of the existing facility and formed part of the required security buffer.

It further argued that to provide housing on the land in question with the existing facility in operation would require considerable changes and upgrades to the security regime, so the land was not suitable for residential development.

It has not been adequately demonstrated that the subject lands are integral to the operation and security of the Currency Centre

The Central Bank also said access to the M50 slip road through the area in question was an integral and essential part of the currency facility and its operations and existing emergency plans.

But An Bord Pleanála inspector John Duffy said the land in question was divided by a wall running along the eastern site boundary of the site from the adjoining site which accommodates the Currency Centre.

“In my view it has not been adequately demonstrated that the subject lands are integral to the operation and security of the Currency Centre,” he said.

Mr Duffy said that land in question was subject to a “specific local objective” which aims to encourage and promote their use for social and affordable housing.

He ruled there were no matters in the appeal that warranted exclusion of the land in question from the RZLT.

The RZLT annual tax on undeveloped lands is calculated at 3pc of the land’s value.