The business model for League of Ireland clubs does not even contemplate turning a profit each year. Ever increasing losses are the accepted norm unless European football is secured throughout the winter months.

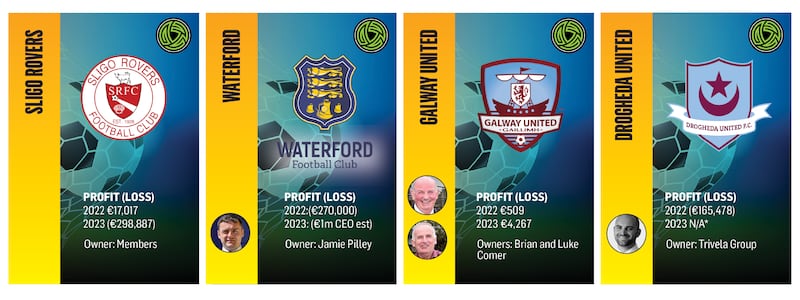

“Nobody would run their own finances like a League of Ireland club,” says Tommy Higgins, the Sligo Rovers chairman and former European director of Ticketmaster.

“Imagine having €300,000 but buying a house for €1 million. Now, the likes of Ray Wilson and Dermot Desmond at Shamrock Rovers, and Philip O’Doherty for years at Derry City have been great for the game. Galway United have the Comer brothers, who are also billionaires, but we do not have that in Sligo, so we have to publish more information than other clubs as we operate as a charity.”

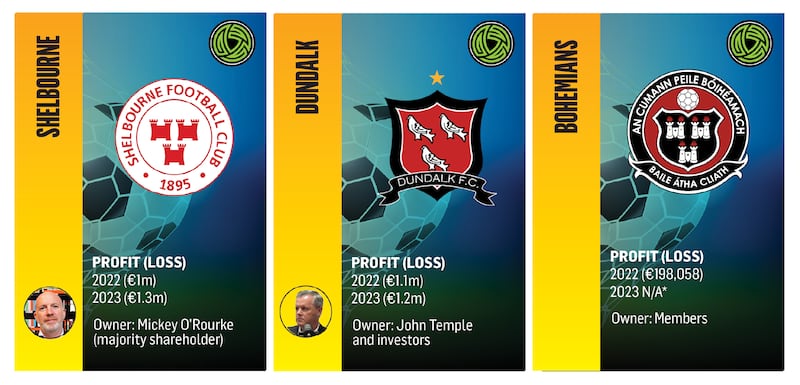

Only one of the 10 clubs currently operating in the Premier Division of the League of Ireland published a profit for 2023. Galway’s balance sheet revealed a €4,297 surplus, after being promoted from the First Division, but that figure is offset by majority shareholders Luke and Brian Comer, the Glenamaddy-raised property developers.

Luke Comer previously revealed they invest “the best part of €1 million” annually into Galway United. This has become standard practice across the league, with two exceptions being the fan-owned Sligo and Bohemians in Dublin.

It costs more than €2 million to run a competitive squad with aspirations of reaching the group stages of European football and a guaranteed €3 million in prize money.

“That two million is not to qualify for Europe, that’s just to come close,” says Higgins, “and we’re at the bottom end of club expenditure.”

Despite winning two qualifying rounds of the Uefa Conference League in 2022, famously knocking out Scottish club Motherwell, Sligo had to slash spending last year by €500,000, down to €2.36 million.

“Without European football we had to cut our budget but we continue to punch above our weight,” Higgins says.

Sligo remains a prudent financial case study despite losses of almost €300,000.

The league continues to experience a surge in popularity, with stadium attendances rising by 23 per cent in 2023. But the sustainability of clubs came into sharp focus last month when Dundalk, under former owner Brian Ainscough, came close to liquidation.

It turns out that an FAI “loophole” allowed Ainscough, a Boston-based businessman originally from Dublin, to avoid financial checks when he took control of the club in December 2023.

“Lessons will be taken away from this process so for any future transfer of ownership that loophole will be closed,” said David Courell, the interim FAI chief executive. “We will be better.”

The FAI carry out three financial checks throughout the season and while there is no “licensing requirement to trade profitably,” owners must provide a letter of “financial guarantee” when a loss is forecast.

The first check, last November, meant that the Ainscough takeover in December slipped under the radar.

“It is an ongoing requirement that clubs may only spend 65 per cent of relevant income on players’ wages for the year,” the FAI said in a statement to The Irish Times.

Dundalk players’ wages are only guaranteed until November 30th, after a consortium led by local barrister John Temple replaced Ainscough, but the club’s financial situation remains “bleak”.

“I have tried to stave off the execution,” Temple says, “but the daggers are growing and hanging over every hour. Hopefully creditors will sit down and negotiate and talk to me.”

Since Peak6, the private equity firm from Chicago, sold Dundalk to Andy Connolly and StatSports pair Alan Clarke and Sean O’Connor in 2021, the club has made losses of almost €2.3 million. Since 2018, this figure rises to €5 million as Oriel Park fell into disrepair even as Dundalk made two trips to the group stages of European football (on the first of those occasions under the leadership of former Ireland manager Stephen Kenny).

Turnover at Dundalk tells its own the story with a drop from €2.3 million in 2022 to €1.7 million in 2023. Sponsorship plummeted by €467,000. Fundraising was one area of improvement, rising from €50,949 to €61,605, but these figures pale in comparison to Sligo Rovers doubling its fundraising to an impressive €600,000.

“It is driven by volunteers, the entire community contributes,” Higgins explains. “There are 20,000 people in the town and 70,000 in the county. We knock on all their doors. We even spread out to a 40-mile radius into Mayo, Leitrim and Roscommon.

“It’s a bit like a religion, in that we have the support of the people. Nobody slams the door in your face but you have to be willing to have a chat before €10 is handed over.”

Sligo’s 500 Club has 700 members each paying €240 a year. It’s an important source of revenue.

“Costs have risen since Covid,” says Higgins. “It’s a small community so we have to bring players in from outside and that means providing accommodation, which keeps going up. Unless you have a wealthy benefactor to write cheques, without expecting much if anything in return, it does not make sense to own a League of Ireland club. There is next to no prize money or TV money.”

Prize money across the men’s and women’s three divisions is just €765,000.

In Phibsboro, Bohemians’ merchandising sales increased by 2,000 per cent in a decade due to innovative away shirts, like the Bob Marley collectible (€75) accounting for a quarter of the league’s commercial revenue.

Bohemians have yet to publish accounts for 2023, having lost €198,058 in 2022 after making a €730,000 profit in 2021. But its current losses are expected to be manageable.

“My fear for the league is a downturn in the global economy,” says John O’Connor, a former Bohs president and an accountant who regularly posts financial information about Irish clubs.

“Mostly, I tweet so Bohs fans can see how quickly it could all go wrong, again. A global downturn has not happened since 2008, but it is cyclical. It will happen. And what then? At least clubs are not building debt, but the reliance on owners to cover loses year on year is worrying.

“League of Ireland revenue is at an all time high but so are club losses. The league is similar to the other European football leagues, in that they are all messed-up business models,” O’Connor says.

The recent bidding war to bring back Dawson Devoy and Ross Tierney from English clubs had Bohs fending off St Patrick’s Athletic to sign the former Ireland under-21 internationals.

“The wage inflation in the league over the last 18 months reminds me of the late 2000s when clubs paid lots of money they didn’t have to players,” O’Connor warns. “We all know how that era ended. In the last three seasons, Sligo wages are up 103 per cent and Derry’s are up 186 per cent. Other clubs are as high or higher. The league certainly has deeper-pocketed owners now, so let’s hope for a different ending overall.”

Shamrock Rovers, the five-in-a-row chasing champions and the league’s highest-profile club, published the highest deficit in 2023 as failure to reach the Uefa Conference League group stages saw a €1.8 million profit from 2022 become a €2.4 million loss.

Rovers are part-owned by Australia-based Irish businessman Ray Wilson and Celtic majority shareholder Dermot Desmond, who bought a 25 per cent stake for €2 million in 2019. The other 50 per cent is controlled by its members.

Rovers returned to the European group stages this season, drawing Chelsea at Stamford Bridge, Larne in Windsor Park and Rapid Vienna away, along with three home ties in the 10,500 capacity Tallaght Stadium on top of a guaranteed €3.2 million in prize money.

The Dublin club would bank another €3 million by progressing to the knockout stages.

In contrast, Derry City’s billionaire owner Philip O’Doherty invested £1.1 million (€1.3 million) last year but failure to progress past the European qualifiers leaves the Candystripes with combined losses of €2.35 million from 2022 and 2023.

Unlike Dundalk and clubs like Shelbourne FC in Drumcondra, with its group of investors, the Sligo business model is not dependent on qualifying for Europe.

Still, the absence of Uefa cash saw their prize money drop from €885,000 to €152,000, which led to a wage bill reduction of €26,000 after they generated €80,000 by selling Max Mata and Aidan Keena.

“We usually lose about €10,000 a year,” Higgins says. “We have debts of €60,000 over five years. Last year’s loss [almost €300,000] was unusual but we’re still alive and paying wages.”

Sligo has 33 employees – 23 players and seven management – which is less than half Shamrock Rovers 70 employees; 54 players (including the women’s squad) and eight on the coaching staff.

“It will not get any easier for Sligo to compete,” Higgins concedes.

“Garrett Kelleher has brought US investors into St Patrick’s Athletic, Cork City are back up and Waterford are funded by the Fleetwood Town [an EFL League Two club in England] owners. European football is going to be very difficult to reach in 2025.”

At least Uefa’s solidarity fund, for clubs not in Europe, has increased to €300,000.

Shelbourne, managed by former Ireland and Chelsea player Damien Duff, gained promotion and qualified for Europe while losing €2.3 million over the past two years.

During this period, Mickey O’Rourke, the owner of pay TV broadcaster Premier Sports, took control at Tolka Park from Turkish businessman Acun Ilıcalı and his multi-club model headed by Hull City in England, following an issue over Duff’s contract extension.

On the cusp of a first title since 2006, Shels recently received €1 million investment from tech-entrepreneur brothers Neil and Cathal Doyle.

St Patrick’s Athletic, controlled by property developer Garrett Kelleher, lost €376,519 in 2023 with Mancar Ltd – Kelleher’s company – owed €2.8 million. New “strategic investors” Kenosis Sports Capital, which includes NFL stars Joe Flacco and Matt Birk, were announced in March.

Drogheda United are the latest to embrace the multi-club-model with a takeover by Trivela, an Alabama-based family office that holds €11 billion in capital and owns Walsall FC in the English fourth tier.

Drogheda/Trivela recently purchased its Weavers Park stadium from the FAI. The club is due to publish its 2023 accounts after posting losses of €165,478 in 2022.

Waterford is another multi-club structure, headed by Fleetwood Town, also in England’s fourth tier, but efforts to see the accounts since the Pilley family took the reins in 2022 have proved unsuccessful.

Jamie Pilley, via The Willows 96 Holdings Ltd, bought the club from his father Andrew Pilley earlier this year after Pilley senior was sentenced to 13 years in prison for fraud.

Steve Curwood is currently chief executive of Fleetwood and executive director of Waterford.

“No issues have arisen for us around [Curwood’s] role with both clubs,” the FAI says.

Waterford FC cannot reveal last year’s financials until they publish their 2022 accounts, which are delayed due to “technical issues”, Curwood told The Irish Times.

“We only part-owned the club for 2022,” he said, “but I can confirm losses of around €1 million in 2023 and something similar in 2024.”

What makes Waterford a worthwhile investment for Fleetwood?

“We’ve a huge desire to qualify for European football and turn Waterford into a school of players for Fleetwood or elsewhere,” Curwood says.

“Take Romeo Akachukwu. We sold Romeo [to Southampton] for around €400,000. Our academy is an untapped market and by using the Fleetwood model we can continue to produce and sell-on quality [Irish teenagers].”

That is how functioning football industries operate in smaller European countries. Gavin Bazunu’s transfers from Shamrock Rovers to Manchester City in 2019 and on to Southampton in 2022 earned his hometown club €3 million due to a sell-on clause in the Irish goalkeeper’s contract.

But the Rovers academy costs €850,000 to run annually, so the challenge is to continually produce Bazunu-type talent.

The FAI hope to transform League of Ireland academies, with the Government asked to supply €10 million a year to create a football industry that currently lacks a requirement to trade profitably. In the wake of Brexit, without high-performing academies operated by League of Ireland clubs, the Irish senior team’s recent woes could become a long-term issue.