Smart money app Plum is expanding its investment offering in Ireland with Exchange-traded funds (ETFs).

They are a pooled investment security that can be bought and sold like an individual stock. ETFs can be structured to track anything from the price of a commodity to a large and diverse collection of securities.

They said customers can invest in 40+ ETFs, starting from just €1.

In partnership with Berlin-based fintech Upvest, Plum now offers its customers investments in Euro-denominated ETFs, including fractional shares.

As a result, Plum is able to offer them a broader, enhanced investment experience, in addition to the 3,000 US stocks it already offers.

The Easy® ETF range, accessible without a paid subscription, consists of three globally diversified ETFs tailored to different risk levels to help customers start their investment journey.

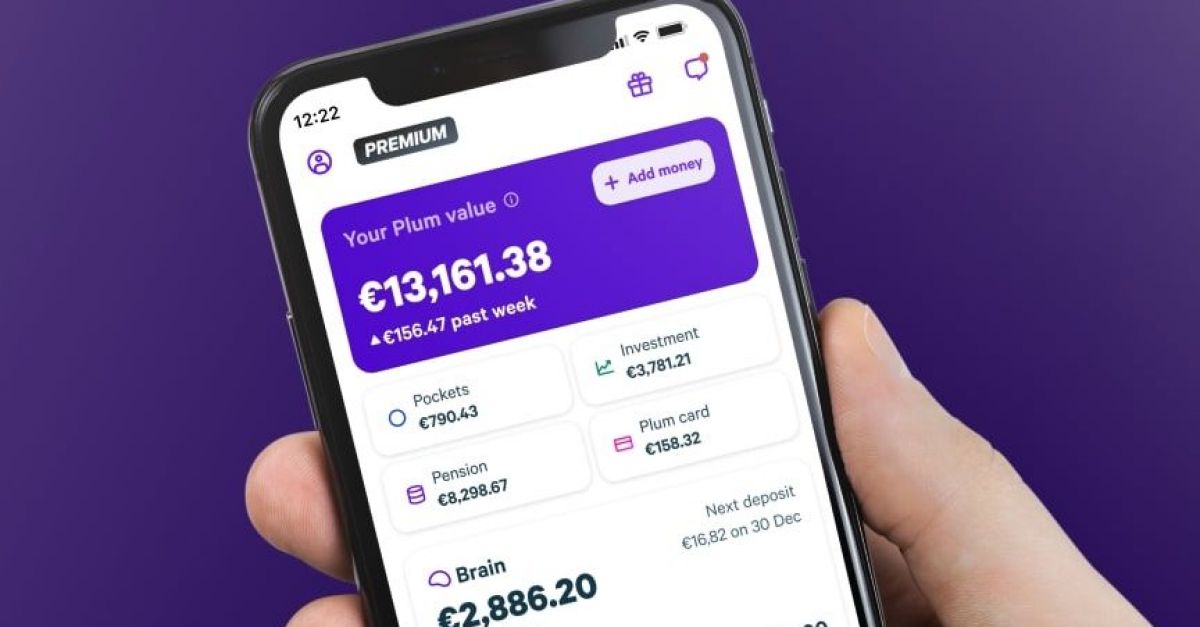

The rest of the ETFs are available with Pro and Premium subscriptions, with more than 40 carefully selected funds on offer in total, such as the S&P 500 US, Artificial Intelligence ETF or Europe Dividend Income.

The launch of ETFs follows ‘Plum Interest’, an product based on a money market fund offering a variable return of up to 3.80 per cent.

Paired with Plum’s stock investing product, the company aims to offer Irish savers a full suite of products to build wealth over the long-term.

Victor Trokoudes, chief executive and founder of Plum said: “We know already that people in Ireland are great at saving. But they’ve been let down by poor interest rates and inaccessible and confusing investment options from the traditional banks and providers.

“That is why we have carefully selected a range of ETFs that will provide customers with more high-quality options to put their money to work.”

“The recent success of our ‘Plum Interest’ product in Ireland shows that people are hungry for innovative products to build their wealth.”